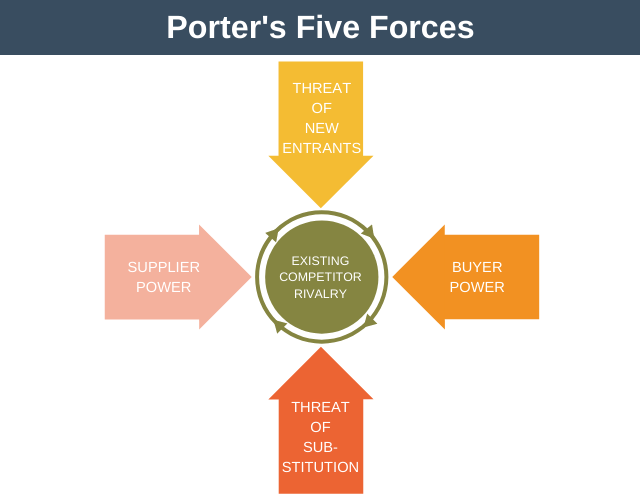

Porter’s Five Forces is a method for analyzing and understanding the competitive forces that are shaping a marketplace. It is especially useful when you’re thinking of entering a new market or starting a new business.

Porter’s Five Forces helps you understand the nature of the competition within a market, and thus how profitable the market is, known as the market attractiveness.

Background

The Five Forces framework was developed by Harvard Business School professor Michael E. Porter.

Since the model was first published in 1979 in the Harvard Business Review, it has been named one of the ten most influential papers ever published by that publication.

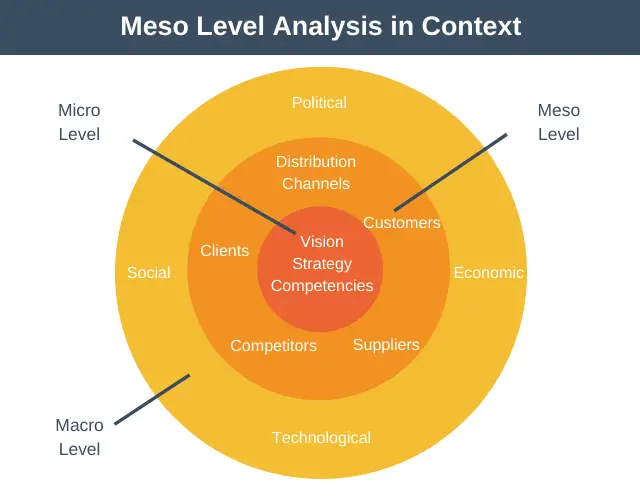

The model works by analyzing factors at the meso level. Meso-level forces are those external forces in direct contact with a company.

The meso level sits between the macro and micro levels of analysis. The macro-level has a one-way effect on a firm, and the firm has no control over it, for example, if the government changes the tax rate there is nothing the firm can do about it. The micro-level is internal to the organization and entirely under its control, so if a firm wants to change the color of its website it can go straight ahead and make it happen.

The meso level sits between these two levels, and whilst firms can influence these factors they don’t have complete control over them.

Most companies already watch their closest competitors’ moves, but carrying out a broader meso analysis such as Porter’s Five Forces allows you to observe and shape other factors that impact your profitability.

Porter developed the Five Forces model in response to SWOT analysis, which he found too subjective and lacking rigor.

Porter’s Five Forces

To use the Five Forces model, you must analyze the five meso-level competitive forces to understand a market’s attractiveness.

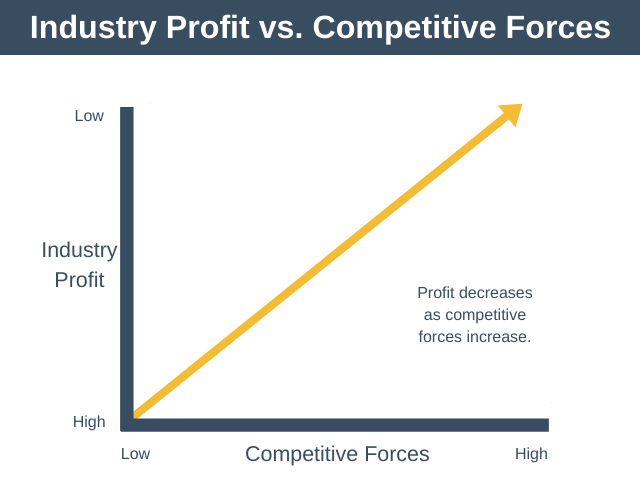

The model essentially says that the higher the competitive forces, the lower the profit potential and the less attractive the industry. Conversely, the lower the competitive forces, the higher the profit potential and the more attractive the industry.

It is important to understand that analyzing an industry using the Five Forces framework gives you a snapshot in time of the industry. Over time, the forces that affect an industry are dynamic and will change in nature. For example, a market might be hard to enter today because of high entry barriers, but this might not be the case ten or twenty years from now.

Let’s examine each of the five forces in turn.

1. Existing Competitor Rivalry

In the middle of the diagram is competition between existing firms, including yours, if you’re already in the market.

The intensity of competition is driven by the number of competitors within the industry and how similar their products are.

If rivalry is intense, this will drive down profits across the industry—fierce rivalry results in firms offering deep discounts and spending large sums on marketing to acquire customers.

When rivalry is intense, it’s often easy for customers to substitute your firm for another. For example, a flight from London to Paris is a flight from London to Paris; does it really matter which airline you fly with?

When you have few rivals, and you’re positioned uniquely, then it’s hard to substitute another product for yours, and consequently, you can charge more, improving your profit margin. This is the reason that Apple can charge more for their laptops than Dell can charge for theirs.

Competition between existing firms is at the center of the diagram to indicate that all the firms jockeying for position within an industry are surrounded by four other powerful forces.

2. Threat of New Entrants

The threat of new entrants to the market puts a limit on how profitable that market can be. This is because the threat alone will force you and your competitors to keep prices low to discourage new entrants.

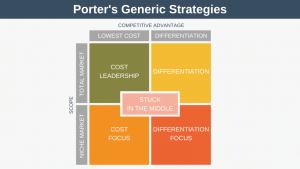

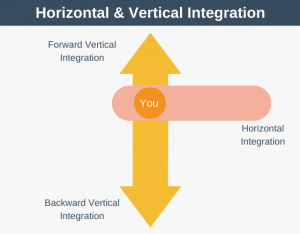

How easy or difficult it is for a new firm to enter the market will depend on the industry’s barriers to entry. Firms create high barriers to entry by possessing unique intellectual property or technology, benefiting from economies of scale, having high brand loyalty, using vertical integration, and government restrictions.

Let’s look at how a fashion firm such as Louis Vuitton might create a barrier to entry. One way they try to do this is through vertical integration. Vertical integration is where a firm owns its suppliers and its distribution channels. In Louis Vuitton’s case, this means owning all its own retail stores. If a new entrant wants to enter the market, having to setup up its own stores to compete is a huge barrier to entry.

If it is easy for new firms to enter your market and compete, then profits will be lower across the industry. If one or more barriers to entry exist, then profits across the industry will be higher.

3. Buyer Power

How much power do buyers within the industry have? If your customers are powerful enough to force you to reduce your prices, profits will be lower across the industry.

Buyer power will be highest when there are few buyers, products are undifferentiated from each other, and the cost of switching from one supplier to another is low.

When buyers have power, they can play rival firms against one another, driving prices down across the industry.

4. Threat of Substitution

How easy would it be to swap your product for an alternative product? This threat isn’t about replacing your product with an identical product but about your customers finding another way to achieve what your product does.

For example, customers might choose to replace your airline’s flights with videoconferencing software. The rise of working from home may limit the rents that commercial office owners can charge.

The existence of substitute products will place a limit on the ceiling price you can charge. Again, this has the overall effect of limiting profitability across the industry.

5. Supplier Power

Your suppliers’ power is determined by how easy it is for your suppliers to raise their prices.

The fewer suppliers there are, and the more unique their product or service, the more power suppliers have. It’s easy for a supplier to raise their prices when their product is unique, and you can’t switch to another supplier.

If your suppliers have high power, they will be able to raise their prices, and this will squeeze your profits because you’ll have no option but to absorb this increased cost.

When this happens, your supplier captures profit from your industry, and profits across your industry are reduced.

High-Profit Industries vs. Low-Profit Industries

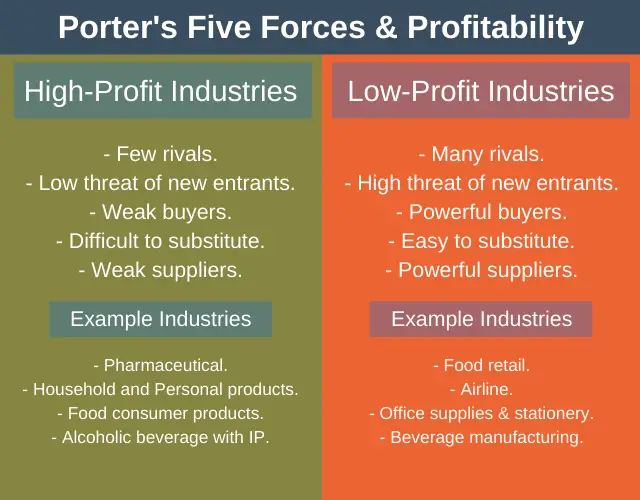

Now that we’ve looked at each of the five forces, it should be apparent that there are some clear differences between high-profitability and low-profitability industries.

These are summarized in the following diagram:

Forces, Not Temporary Factors

One nuance to be aware of with Porter’s Five Forces model is that you should focus on persistent forces impacting profitability and not temporary factors that may make an industry look more (or less) attractive in the present moment but which won’t persist.

An example of a temporary factor that can make an industry look attractive, but one which won’t persist, is a high-industry growth rate.

How to Use Porter’s Five Forces

Cast your mind back to the beginning of this article when we said that Porter’s Five Forces was a meso level analysis. This means that the five forces around you impact you, but it also means that you can influence or change these forces.

This is the real power of the model. It enables you to shape these forces to make your business more profitable. This makes a Five Forces analysis a great input to the creation of your organization’s strategy.

Porter’s Five Forces Example

For this example, we’re going to look at the launch of Apple’s iPhone in 2007.

In 2005, six companies dominated the cellular phone business, capturing approximately 90% of the global handset business. The largest was Nokia, with almost a third of the worldwide market (32.5%) selling over 265 million handsets in 2005 alone.

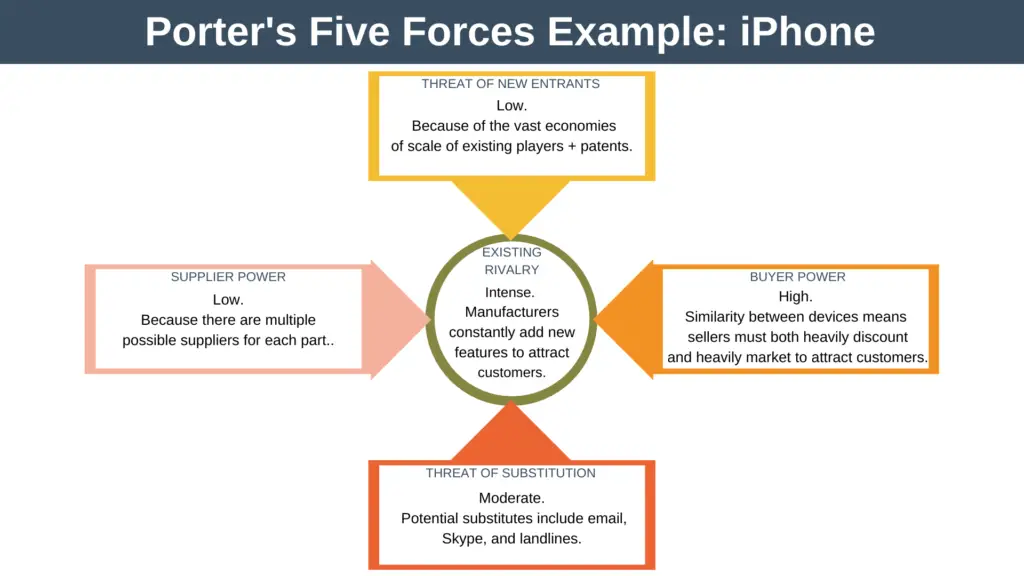

Despite the market growing by 21% in 2005, if you were to analyze it using Porter’s Five Forces, then you might conclude the following.

- Existing Competitor Rivalry: Intense. Manufacturers are constantly adding new features to attract customers, but overall products are somewhat similar.

- The threat of New Entrants: Low. Vast economies of scale are held by the major players. It would be challenging to achieve cut-through in the marketplace as a new entrant because of the enormous marketing budgets of existing players. Existing patents also make it expensive to enter the market.

- Buyer Power: High. Buyers number in their hundreds of millions each year but have high bargaining power as the similarity between devices means sellers must both heavily discount and heavily market their products to attract customers. Switching costs from one manufacturer to another are also relatively low.

- The Threat of Substitution: Moderate. In the mid-2000s, cell phones were used to keep in touch via phone calls and text messages. Potential substitute products include email, Skype, and landlines.

- Supplier Power: Low. There are multiple possible suppliers for most components, so their power is relatively low. Obviously, where a component is unique to a single supplier, bargaining power will be higher.

This situation is summarized in the following diagram:

As you can see, in 2005, the mobile device market was highly competitive, with several big players dominating the market. These big players benefited from economies of scale and patents, making it difficult for new entrants to the market.

Although the market is growing massively year on year, this is a temporary factor. So you’d be forgiven for concluding the market is an undesirable one as there is massive competition amongst existing players combined with high customer buying power.

But obviously, Apple didn’t look at the market and run. Instead, they entered it and were highly successful. They did this by building a product that meant:

- Existing competitor rivalry: wasn’t an issue because the product was so unique.

- The threat of new entrants: would go down over time because of Apple’s app ecosystem. Why would developers switch to a new entrant when all the money is being made with the Apple ecosystem.

- Buyer power: Buyer power is reduced because there is no direct natural alternative.

- The threat of substitution: Lower than before. The features the new phone offered were closest to a computer but these had the disadvantage of not being handheld.

- Supplier power: remains relatively low, as before.

In a nutshell, Apple influenced Porter’s Five Forces so that they were in their favor.

Porter’s Five Forces Template

If you intend to perform your own Five Forces analysis, then you can download our Porter’s Five Forces Template as seen from here.

Advantages and Disadvantages

There are several advantages and disadvantages associated with Porter’s Five Forces.

Advantages

- The framework is easy to both understand and use.

- It helps you to assess the attractiveness of an industry. From this, you can:

- Choose to enter or not enter the industry.

- Select your strategy to defend against these forces.

- Position yourself, so the forces are less severe.

Disadvantages

- Porter’s Five Forces analyzes an industry as a snapshot in time. In reality, the industry is constantly changing because of new strategies adopted by firms within the industry.

- Suppliers having power is assumed to be a negative, but many organizations use joint ventures and affiliations to thrive mutually.

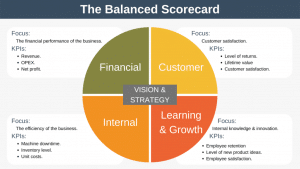

- The model alone isn’t enough to enable a company to set its strategy. It will also need to consider multiple other factors, such as its strengths and weaknesses.

- You can argue that a company’s positioning is more important for profitability than the industry in which it operates.

Porter’s Five Forces Summary

Porter’s Five Forces is a framework that can help you understand an industry’s attractiveness at a moment in time.

It does this by examining the fundamental forces driving the profitability of an industry as a whole: existing competitor rivalry, the threat of new entrants, buyer power, the threat of substitution, and supplier power.

The model essentially says that the higher the competitive forces, the lower the industry’s profit potential. Conversely, the lower the competitive forces, the higher the profit potential of that industry.

The real power of Porter’s Five Forces is that it gives you a starting point to think about how you can shape the forces to be in your favor.