The Ansoff Matrix, also known as the Product/Market Expansion Grid, is a framework that can help your organization develop growth opportunities. Additionally, it enables you to understand the inherent risk associated with each growth option.

The output from the Ansoff will be one or more potential ways for your organization to grow.

Alternative Names

The Ansoff Matrix goes by several different names, including the Product/Market Expansion Grid, the Product-Market Matrix, and the Corporate Ansoff Matrix.

The Ansoff Matrix

The Ansoff Growth Matrix was first introduced in the Harvard Business Review in 1957 in an article called Strategies for Diversification by Igor Ansoff, an applied mathematician and business manager.

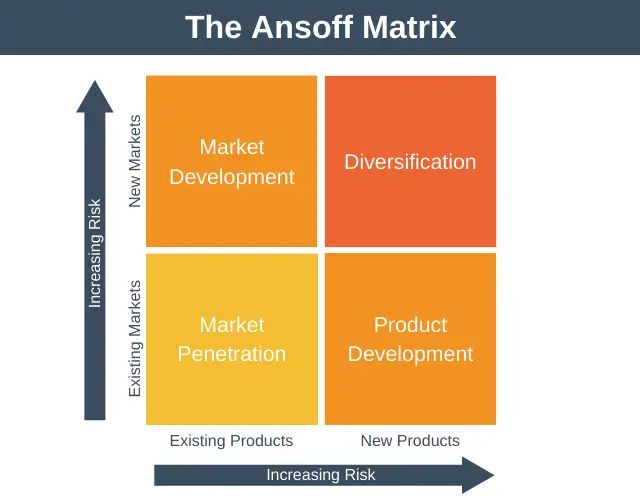

According to the Ansoff Matrix, there are essentially just two options available to firms that want to grow: changing what is sold (product growth) and/or changing who it is sold to (market growth).

When combined into a matrix, the options result in four strategic options, each with a different level of risk and reward.

From the diagram, you can see that four strategies for growth are:

- Market Penetration Strategy – where the company tries to grow the market share of its existing products.

- Market Development Strategy – where the company tries to grow by taking its current products to new markets.

- Product Development Strategy – where the company tries to grow by taking new products to its existing market.

- Diversification Strategy – where the company tries to grow by creating new products and taking them to new markets.

The easiest way to understand the matrix is to imagine that before you begin your Ansoff Matrix, you are positioned in the bottom left of the diagram.

The next thing to understand is that the more’ newness’ you introduce to your strategy, the greater the risk of failure. That is, the more you move away from your starting position, the greater the risk of failure.

This means that the lowest risk strategy is to sell more of your existing products to your current markets because this involves moving the least distance from your starting position.

If you decide to create a new product or sell to a new market, the risk increases as you’re moving away from your starting position either horizontally or vertically.

Finally, suppose you decide to create new products AND sell those products to entirely new markets. In that case, the risks are greatest, as you’re moving away from your starting position both horizontally and vertically.

It’s important to understand that just because the risks are high does not mean you shouldn’t follow a particular approach. It is up to you to choose the right strategy for your firm by balancing the risks against the potentially higher rewards a riskier strategy may bring.

Once you’ve chosen the right strategy for your organization, you can then take steps to manage and mitigate the risks as you execute your strategy.

Let’s examine each of the four growth strategies in turn.

1. Market Penetration

With this strategy, you aim to grow your organization by selling more of your existing products and services to your current markets. Another way to say this is that you are trying to increase your market share within your existing markets.

There are several different ways in which organizations can seek to improve market penetration, including:

- Enticing customers away from competitors. This is usually achieved through a combination of aggressive pricing and advertising campaigns but could also be achieved by beefing up the size of your sales force.

- Encouraging existing customers to become more frequent users of your products, for example, by introducing loyalty cards.

- Acquire a competitor. This strategy can be incredibly successful if increased volumes mean disproportionate economies of scale to your organization and therefore increased profit margins.

2. Market Development

This strategy aims to secure growth by selling existing products to new markets. This strategy refers to markets in the broadest sense and could mean new customer segments or new overseas markets.

There are several different ways in which organizations can seek to develop a market, including:

- Entering new territories, for example, launching your product in a new country.

- Creating new product dimensions or new packaging.

- New distribution channels, for example, a store selling only face to face opening an online store.

- Creating products targeted at different market segments, for example, the same product might be packaged differently to appeal to different genders or age groups.

Market development can sometimes be the obvious choice, for example, when there are large and untapped markets beckoning or new distribution channels have opened up, making it easy to supply new markets.

3. Product Development

With this strategy, you attempt to secure growth by creating new products for your existing markets.

There are several ways you can seek to develop products, including:

- Investment in research and development. This can be the obvious choice if you are non-competitive because your competitors have better products.

- Buying the rights to someone else’s product.

- Bringing out new product updates to make previous models less desirable. For example, Apple regularly releases new iPhones at a higher price than previous models.

4. Diversification

Using this strategy, you aim to grow by offering new products to new market segments. This strategy is the highest risk, but conceptually it can offer the highest rewards.

There are two broad types of diversification:

- Related Diversification: where new markets you enter or products you create share some similarity with existing products or markets.

- Unrelated Diversification: when completely new products are introduced to entirely new markets.

In theory at least, related diversification is a lower-risk option than unrelated diversification.

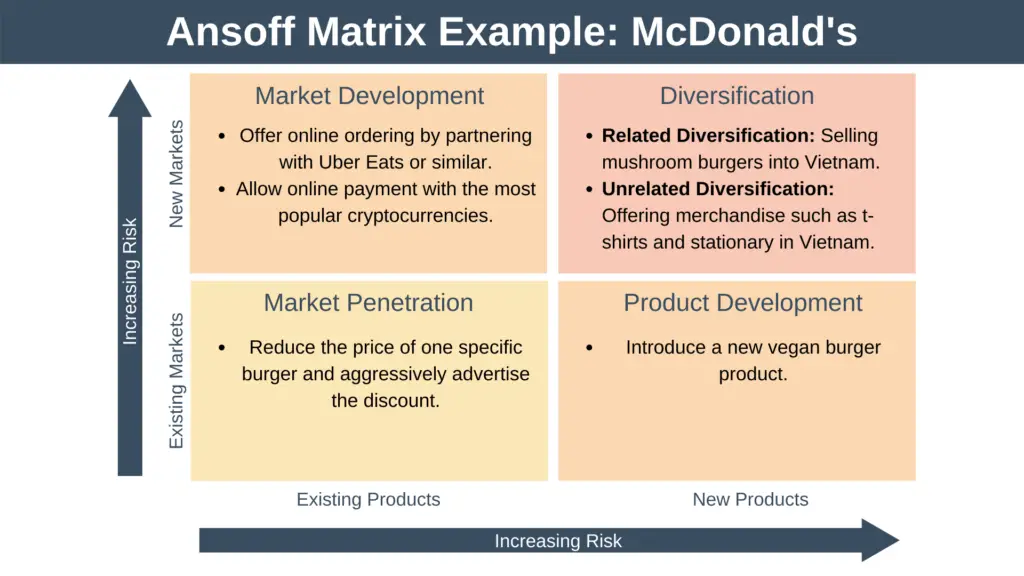

Ansoff Matrix Example

As a simplified example of how the Ansoff Matrix might be used in the real world, we’re going to look at how McDonald’s might populate the matrix.

Let’s run through each strategic option and its purpose that you can see in the example above.

Market Penetration

- Reduce the price of one specific burger and aggressively advertise the discount.

- This strategy aims to grow market share by capturing new customers from competitors.

Market Development

- Offer online ordering by partnering with Uber Eats or similar.

- Allow online payment with the most popular cryptocurrencies.

- This strategy aims to open new channels to make it easier for new and existing customers within your existing markets to get hold of your products.

Product Development

- Introduce a new vegan burger product.

- This strategy aims to grow market share by attracting new customers who previously may have felt McDonald’s wasn’t for them.

Diversification

- Related Diversification: Selling mushroom burgers (a new product) into Vietnam (a new market).

- Unrelated Diversification: Offering merchandise (new products) such as t-shirts and stationary in Vietnam (a new market).

- This strategy aims to achieve growth by launching a brand new product in a brand new market.

The market penetration strategy whereby McDonald’s is trying to sell more of its products to existing customers is the least risky. Conversely, McDonald’s trying to sell mushroom burgers (a new product) to Vietnam (a new market) is the riskiest strategy to achieve growth.

Ansoff Matrix Template

If you’d like to perform your own Ansoff Matrix analysis, you can download our free template here.

Personal Ansoff Matrix

Although the Ansoff Matrix is most frequently used to help organizations find and understand their growth opportunities, you can also use it as a personal career planning tool.

It can help you to understand what career options are available to you, along with the risks and rewards associated with each. From this information, you can choose the right career option for you.

Ansoff Matrix Advantages and Disadvantages

There are several advantages and disadvantages associated with the Ansoff Matrix.

Advantages

The advantages of the Ansoff Matrix include:

- It is easy to understand, making it a great tool to use when collaborating with colleagues or performing presentations.

- It ensures all four growth strategies are considered, helping avoid a rash decision without considering all options.

- It forces organizations to consider the risks associated with each option, so they don’t immediately choose the highest reward option without being aware of the risks.

Disadvantages

The disadvantages of the Ansoff Matrix include:

- It is somewhat myopic and insular as it doesn’t take any account of what your competitors are doing.

- It doesn’t provide any mechanism to weigh up the risk-reward profile of each of the different options.

Summary

The Ansoff Growth Matrix can help organizations make strategic decisions about how to grow. It is based on the idea that there are just two fundamental options available to firms that want to grow: changing what is sold (new products) or changing who it is sold to (new markets).

The matrix also incorporates the concept of risk to help strategists better understand the intrinsic risk associated with each growth option.