When it comes to investing in new projects, every business faces the challenge of choosing which opportunities will yield the best returns while aligning with their strategic goals. The Profitability Index (PI) is a powerful tool that helps address this problem.

What is the Profitability Index?

The Profitability Index, or PI, is a financial metric used to evaluate the attractiveness of an investment or a project.

It’s calculated by dividing the present value of future cash flows by the initial investment cost. In simple terms, the PI helps you understand how much value an investment will generate for every dollar spent.

It’s a tool that’s often used for capital budgeting.

What Is Capital Budgeting?

Capital Budgeting involves planning and evaluating major investments or expenditures. The main goal is to determine which projects or long-term investments should receive funding and how these investments will impact the organization’s financial future.

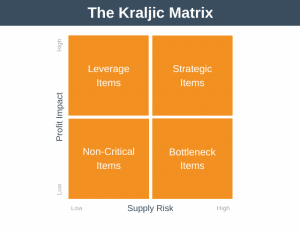

When assessing potential projects, you’ll often utilize financial metrics such as:

- Net Present Value (NPV)

- Return on Investment (ROI)

- Payback Period

- Profitability Index (PI).

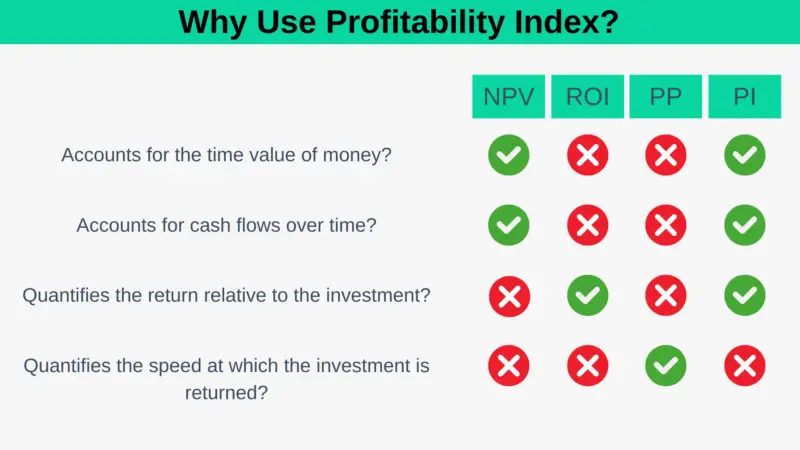

Why Use Profitability Index?

To understand why you might choose to use the Profitability Index over some of the other tools available, look at the table below, which shows the differences between them.

So, you might choose to use the Profitability Index because, apart from not telling you how quickly your investment is paid back, it covers all of the bases in the above table. It accounts for the time value of money, cash flows over time, and quantifies your return relative to your initial investment.

Another reason to use it is that it instantly tells you which investment provides the best return per dollar invested.

What is the Profitability Index?

The Profitability Index, or PI, is a financial metric used to evaluate the attractiveness of an investment or a project. It’s calculated by dividing the present value of future cash flows by the initial investment cost. In simple terms, the profitability index helps you understand how much value an investment will generate for every dollar spent.

How to Use the Profitability Index

To use the profitability index, you need to follow three steps:

- Estimate the future cash flows expected from the project.

- Calculate the present value of these cash flows using a discount rate.

- Divide the present value by the initial cost of the project.

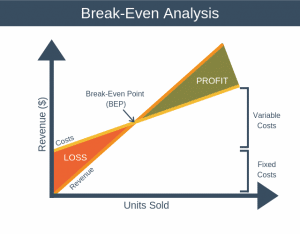

Upon doing this, your profitability index will tell you whether your project is profitable. A profitability index:

- Greater than 1 indicates a potentially profitable investment, suggesting the project’s returns exceed its costs.

- Less than 1 indicates that the project will lose money, and it might be wise to reconsider the investment.

- Equal to 1 indicates that the project is expected to break even. There is no reason to start a project that will only break even unless it provides some strategic benefit to your organization.

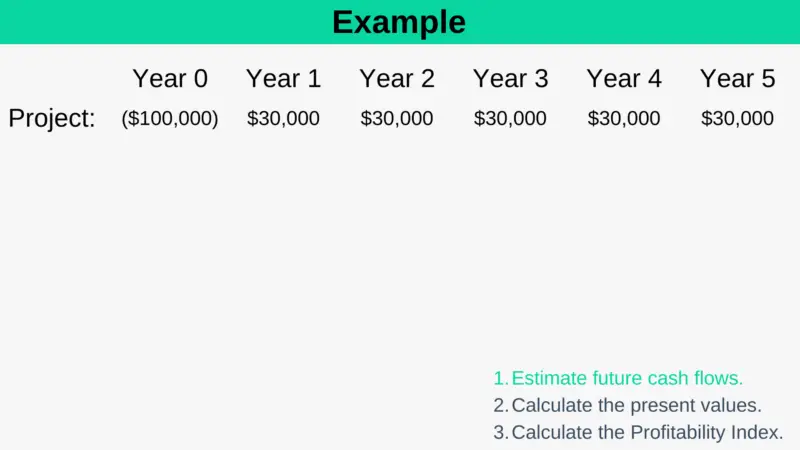

Profitability Index Example

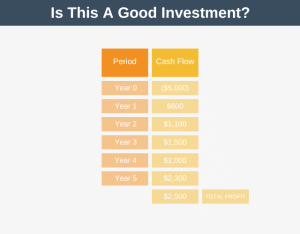

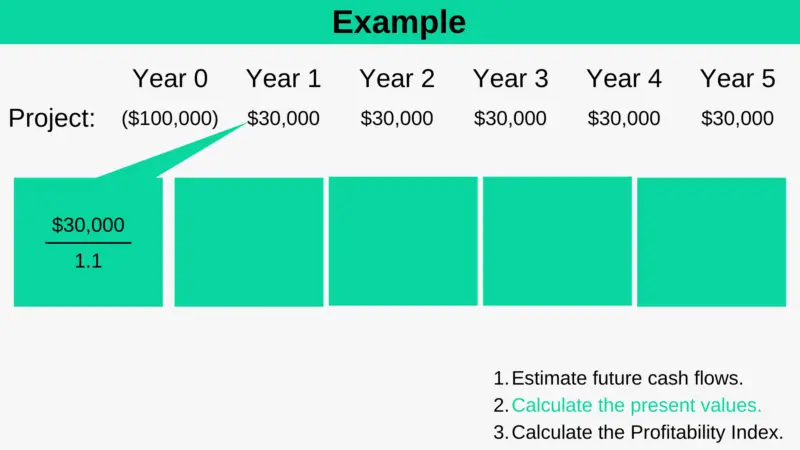

Imagine your company is considering purchasing a new piece of equipment for $100,000, expected to generate additional cash flows of $30,000 per year for the next five years. Assuming a discount rate of 10%, let’s calculate the profitability index.

Step 1: Estimate future cash flows.

You already know that you expect the project to bring in $30,000 annually for five years. This is represented in the image below.

Step 2: Estimate present value

As you can see, you’re spending $100k, which returns $50k profit, meaning you’re making a 50% profit on your investment. Another way to say this is that you’re making an ROI of 50%.

Now, a 50% return might initially sound pretty good, but what you’re not taking into account is the fact that the value of money is eroded through inflation every year. So $100 dollars in five years’ time isn’t going to buy you anywhere near what $100 can buy you today.

This is why we have step 2. It’s there to calculate what the future cash flows you expect are worth today. So, let’s take a look at how you calculate them.

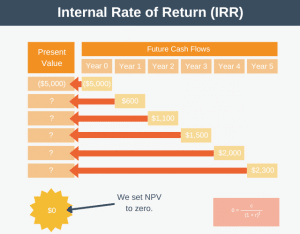

Tip: There’s more to calculating NPV than we show you here. So, if you’d like to learn more about calculating net present values, look at our dedicated NPV article.

To calculate the present value of your year one cash flows, you simply divide 30,000 by 1.1, with 1.1 representing your hurdle rate of 10%

If your hurdle rate were 20%, you’d set this to 1.2. If your hurdle rate were 35%, you’d set this to 1.35 etc.

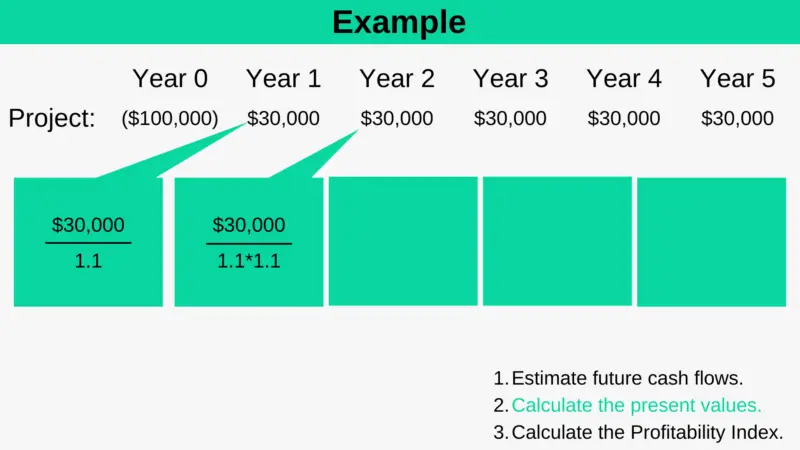

To calculate the present value of your year 2 cash flow, you use a very similar calculation, except this time, you multiply the 1.1 by another 1.1 because you need to discount your year 2 cash flow by two years’ worth of hurdle rate.

Basically, we take our 30,000 for year 2, discount it by 10% to get its year 1 value, and then discount it by another 10% to figure out what it’s worth to us today.

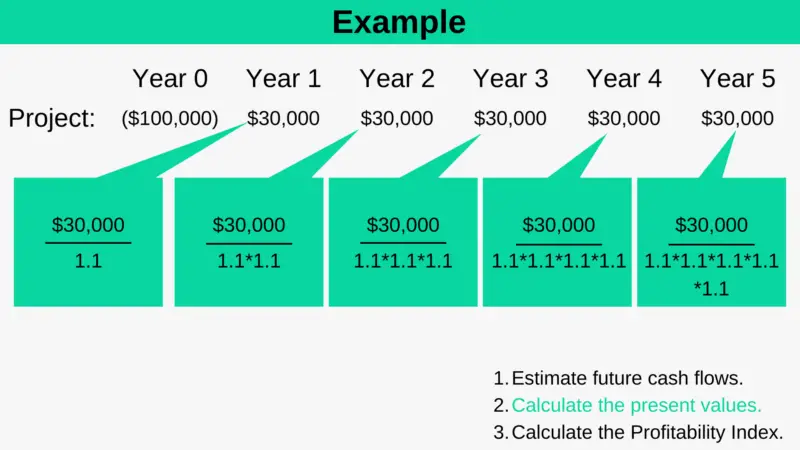

Repeating this for all five years, we get:

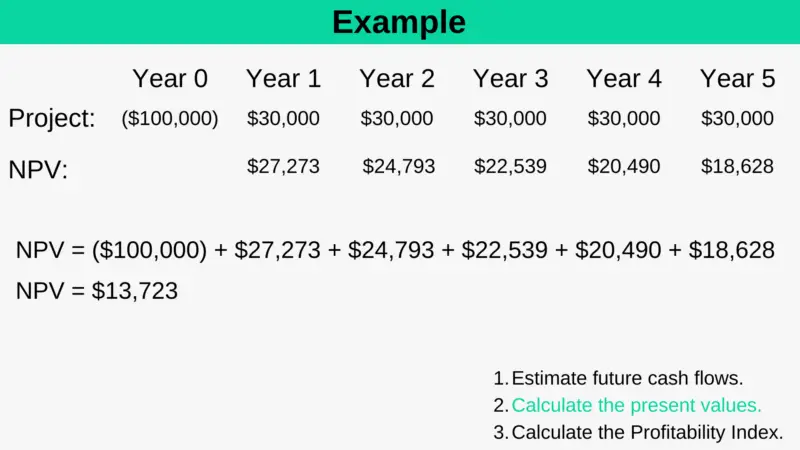

If we then calculate all our present values, we end up with this:

Now, if you add everything up, that gives you an NPV of $13,723.

The good news is that your number is positive, which means you’ve made a profit. If the number were negative, then you would have made a loss.

The not-so-good news is that by translating your future cash flows into what they’re worth today, you’ve only made a profit of $13,723 against your initial $100k investment. Nowhere near as good as what the ROI figure you’d previously calculated would have led you to believe.

You’re now ready to calculate our profitability index, which is the final step.

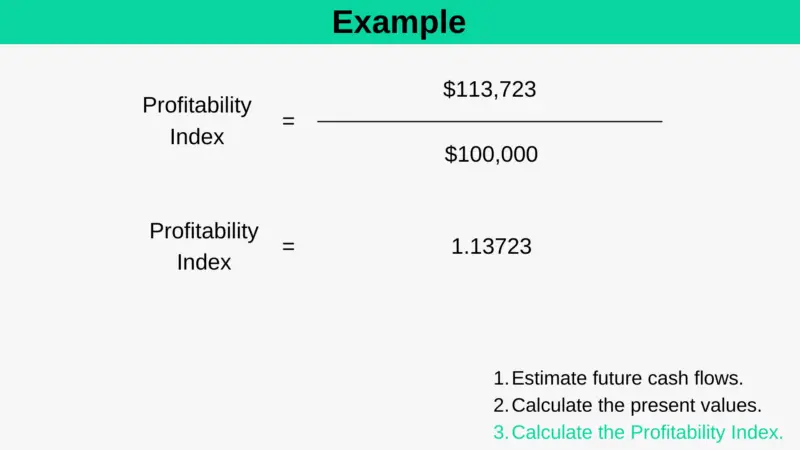

Step 3. Calculate the profitability index.

The profitability index is then calculated as adding up all the future cash flows (note that we exclude our initial investment from this), and then dividing by the initial investment.

For our example, that gives you 113,723 divided by your initial investment of $100,000

That gives you a profitability index of 1.13723

That’s good news. A value greater than 1 means a project is profitable, whereas a value less than 1 means the project is unprofitable.

The big advantage of PI is it allows you to compare the relative profitability of multiple projects quickly, even when they differ significantly in scale and investment required.

Advantages of the Profitability Index

The Profitability Index offers several advantages:

- Efficiency in Comparing Projects: PI helps compare the relative profitability of multiple projects quickly, even when they differ significantly in scale and investment required.

- Value-Oriented: By focusing on the value created per unit of investment, PI aligns closely with the goal of maximizing shareholder value.

- Useful in Capital Rationing: It is particularly beneficial when resources are limited, helping prioritize projects that provide the highest value return per dollar invested.

Disadvantages of the Profitability Index

However, the PI is not without its drawbacks:

- Dependence on Accurate Cash Flow Forecasting: Like any tool based on discounted cash flows, the accuracy of PI calculations heavily relies on the precision of future cash flow estimates.

- May Ignore Absolute Profit Sizes: PI does not consider the total profit volume. A project with a high PI but a relatively small total profit might be less desirable than a larger project with a slightly lower PI.

- Complexity in Calculation: Calculating present value involves assumptions about the discount rate and future cash flows, which can complicate the process.

Our Take

The Profitability Index is a practical and effective tool for making informed investment decisions. It provides a quick and straightforward metric that helps compare the potential returns of different projects relative to their costs. However, like any analytical tool, its effectiveness is contingent upon the accuracy of the input data and the context in which it is used. When you understand its limitations and use it in conjunction with other financial metrics and qualitative factors, the PI can significantly enhance your decision-making process in project evaluation and capital allocation.

By integrating the PI into your financial toolkit, you can better navigate the complexities of investment opportunities, ensuring that your capital is deployed in the most profitable ventures possible. Whether managing small projects or large-scale investments, mastering the Profitability Index will empower you to optimize your returns and achieve your business objectives more efficiently.

References:

- “Principles of Corporate Finance” by Richard A. Brealey, Stewart C. Myers, and Franklin Allen.

- “Corporate Finance” by Stephen A. Ross, Randolph W. Westerfield, and Jeffrey Jaffe.