Have you ever wondered why a Big Mac costs close to $6 in the US but just $3.50 in China? And why does a can of Coca-Cola cost approximately $2.50 in the US but just $1.32 in Mexico? The answer can be explained by a concept called purchasing power parity, which is a way of leveling prices across countries to take account of real purchasing power.

What is Purchasing Power Parity?

Purchasing Power Parity (PPP) is an economic theory that posits that the exchange rates between currencies are in equilibrium when their purchasing power is identical in each respective country.

Why Use Purchasing Power Parity?

In short… because it can increase revenue and profit.

Purchasing Power Parity is especially useful to businesses with a low marginal cost wanting to sell their products or services internationally, for example, software as a service businesses (Saas).

Using PPP, these businesses can set their prices to take into account the economic reality of each country in which they sell their product, making their product affordable and competitive with local competitors.

Rather than reducing revenue through reduced prices, PPP can help businesses increase sales and maximize revenue.

Understanding Purchasing Power Parity

Let’s look at an example to make sense of purchasing power parity.

Imagine that the exchange rate between the US and UK is £0.60, meaning that $1 is worth £0.60. This is known as the nominal exchange rate, and in a perfect world, it would reflect the difference in purchasing power between the two currencies.

Suppose you’ve bought a basket of goods that cost $1,000 in the US, and you wanted to buy that same basket of goods in the UK.

In an ideal world, using the nominal exchange rate of £0.60, your $1,000 basket in the US should cost £600 in the UK.

However, we don’t live in an ideal world, and nominal exchange rates can fluctuate wildly for all kinds of reasons, such as trader speculation, interest rates, inflation expectations, etc.

Because nominal exchange rates can fluctuate so much, they don’t always reflect purchasing power. This is why economists and businesses prefer to use real exchange rates. This real exchange rate is also called the purchasing power parity between two countries.

The real exchange rate and purchasing power parity are exactly the same thing.

Now imagine you actually went to the UK with your $1,000, which you converted into £600 using the nominal exchange rate or nominal exchange rate, and you wanted to buy that same basket of goods.

If you discovered that it would cost you £800, you’d be £200 (or $333) short.

This is the real exchange rate. This is purchasing power parity.

The reality of the situation is that you need $1,333 to buy the equivalent of your $1,000 basket of goods in the UK. We can say that the real exchange rate or purchasing power parity is actually £0.80.

This means that the dollar’s nominal exchange rate (£0.60) is undervalued, as it is not buying you as much as you might expect. An undervalued dollar means it holds less purchasing power than the pound.

Similarly, we could say that the pound is overvalued. An overvalued pound means that it has more purchasing power relative to the dollar.

Example

Imagine you run a U.S.-based software company that develops productivity tools. This company, let’s call it “EfficientSoft,” charges $100 annually for a subscription to its product, which it sells online.

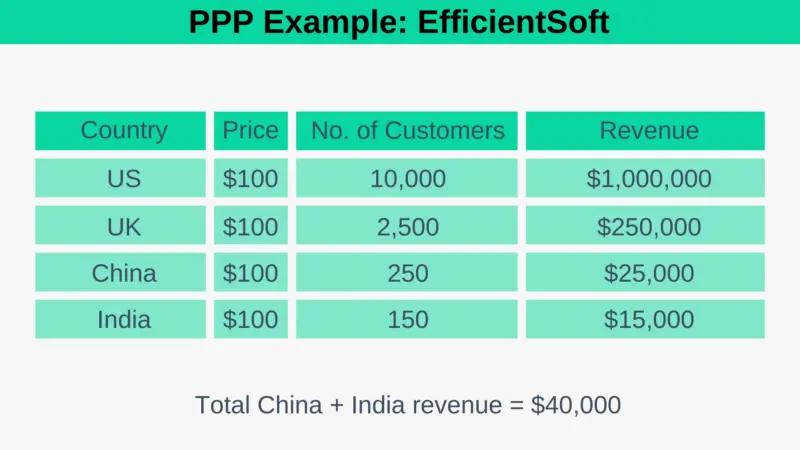

EfficientSoft primarily focuses on the US market, but because it sells online, it also has customers worldwide. A simplified breakdown of its global sales breakdown might look something like this:

The main things to note from this example are that:

- You charge the same price, $100, in all countries.

- The US is your biggest market, and India is your smallest. Also, note that you sell substantially less in China and India than you do in the US and UK.

- The total revenue generated by the Chinese and Indian markets is $40,000

EfficientSoft realized that the average income in China and India is significantly lower than in the U.S.

For China, while the direct currency conversion rate would suggest setting the Chinese price at 700 Chinese Yuan (assuming an exchange rate of 7 CNY/USD), the average income data and local purchasing power data indicate that such a price would be prohibitively expensive for most Chinese consumers. Instead, using PPP, EfficientSoft decided to price the subscription at 350 CNY, which is more aligned with the local economic environment.

This price adjustment makes the subscription more affordable for Chinese customers and helps EfficientSoft remain competitive against local providers, increasing its market share in China.

EfficientSoft also adjusts its prices for the Indian market using purchasing power parity exchange.

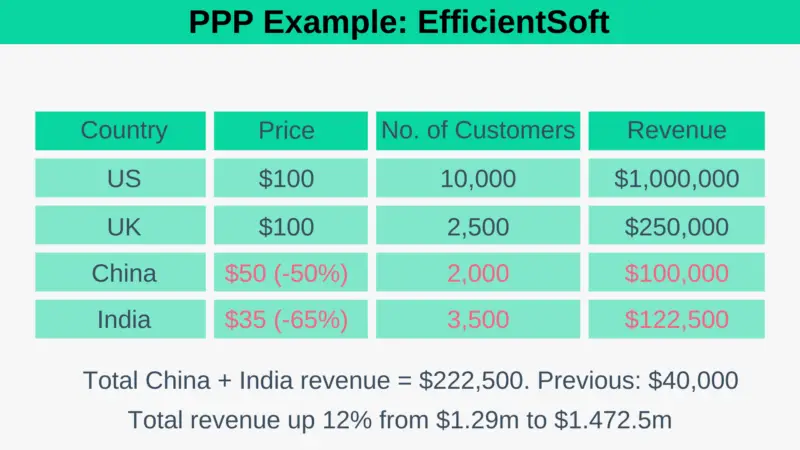

One year later, assuming no changes in the US and UK, the net result of these changes can be seen in the sales table below:

As you can see above, by adjusting their prices for China and India using purchasing power parity, EfficientSoft has dramatically increased its sales and revenue in both China and India.

Not only that, but despite the price dropping in these two markets, the revenue generated from these two countries has increased substantially, from $40,000 before the change to $222,500 after the change, an increase of over 500%.

Without any contribution from the US or UK, EfficientSoft has increased its total revenue by over 12%, from $1,290,000 to $1,472,500.

Another benefit of this change is that the company, while still heavily reliant on its US market, is now less reliant than it was before.

The Big Mac Index

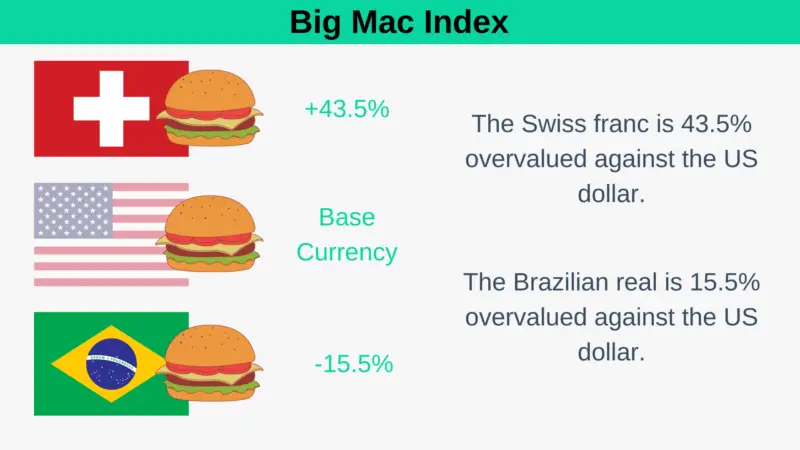

Let’s examine the Big Mac index, which is based on purchasing power parity.

Created by The Economist in 1986, the index uses the price of a Big Mac hamburger in McDonald’s restaurants across different countries to determine whether currencies are at their “correct” level according to PPP.

The Big Mac was used for this because it is sold in over 100 countries. The basic idea is that a Big Mac should cost the same in all countries when the price is converted into a common currency, typically the U.S. dollar.

The index compares the actual exchange rates with purchasing power parity, providing a simple and intuitive measure of currency under or overvaluation.

If a Big Mac is more expensive in one country compared to another when prices are converted at current exchange rates, the currency in the first country is considered overvalued and vice versa.

As you can see in the above example, using purchasing power parity rather than the nominal exchange rate, the Swiss franc is 43.5% overvalued against the US dollar, while the Brazilian real is 15.5% undervalued.

Advantages & Disadvantages

Advantages of PPP

- Simplicity and Intuitiveness: PPP provides an easy-to-understand framework for comparing different economies.

- Inflation Adjustment: It offers a mechanism to adjust for inflation differences between countries, helping compare economic output and living standards more accurately.

- Long-term Economic Planning: PPP benefits strategic planning, investment decisions, and long-term forecasts for businesses and policymakers.

Disadvantages of PPP

- Market Distortions: External factors like tariffs, taxes, and trade barriers can skew PPP calculations, leading to inaccuracies.

- Non-Uniform Availability of Goods: The absence of identical goods across markets or significant variations in quality can compromise the effectiveness of PPP.

- Services and Non-Tradeables: PPP often struggles to accurately reflect the value of non-tradeable services, such as healthcare and education, which can vary widely in quality and cost.

Our Take

Purchasing Power Parity (PPP) is an essential analytical tool for understanding cost-of-living differences across countries. While PPP has flaws, it remains a powerful model for economic analysis.

For business strategists, policymakers, and global investors, PPP offers insights into where currencies stand in terms of real economic value, which is invaluable for making informed decisions. Companies like EfficientSoft, in our example, can use PPP to strategically price their products in international markets, ensuring competitiveness and affordability while accounting for local economic conditions and ultimately maximizing revenues.