This article will explain IRR, otherwise known as the Internal Rate of Return.

Businesses have limited funds to invest, so every business will want to ensure it invests its limited funds in such a way that it generates the best return on its investment.

This is precisely what IRR helps you to do. It enables you to estimate a rate of return for each project you have under consideration so that you can choose to invest in the best one.

Net present value (NPV) and internal rate of return (IRR) are very closely related. If you don’t fully understand net present value, we recommend you read our article explaining net present value before continuing with this article.

Internal rate of return is very similar to net present value, but instead of deciding your discount rate upfront, IRR works by calculating what discount rate will give you an NPV of zero.

The value calculated gives us the IRR of the project, essentially, the rate of return of the project. Thus, IRR enables us to compare the attractiveness of one project against another. The higher the IRR, the higher the return of the project.

How to Calculate NPV

The easiest way to understand IRR is to work through an NPV example and then show how IRR relates to it. So let’s do that.

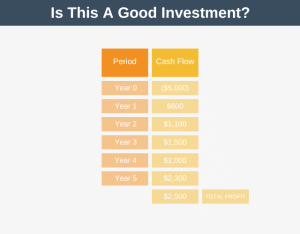

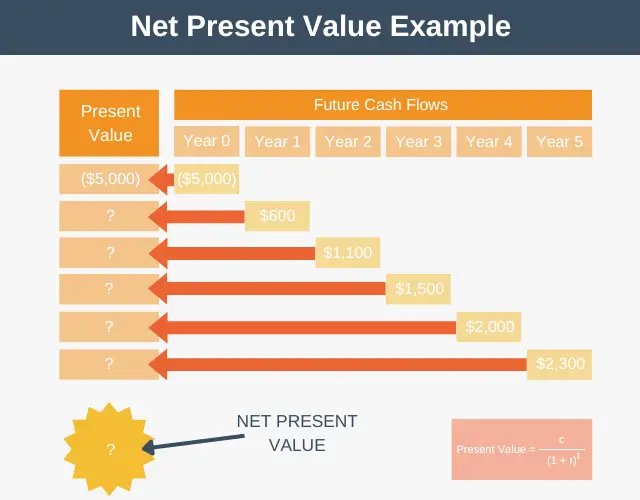

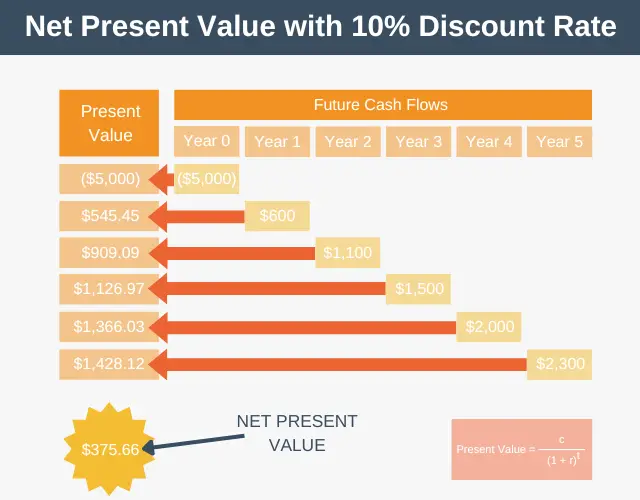

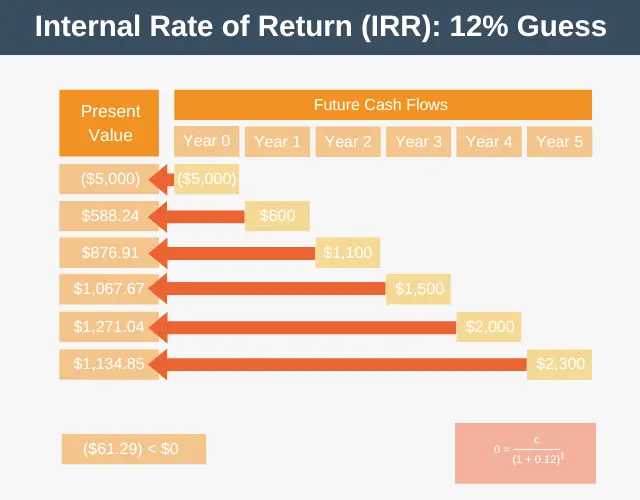

Suppose you have a project under consideration that produces the cash flows shown in the image.

As you can see, this project requires an initial $5,000 investment and then produces returns of $600, $1,100, $1,500, $2,000, and $2,300 over five years.

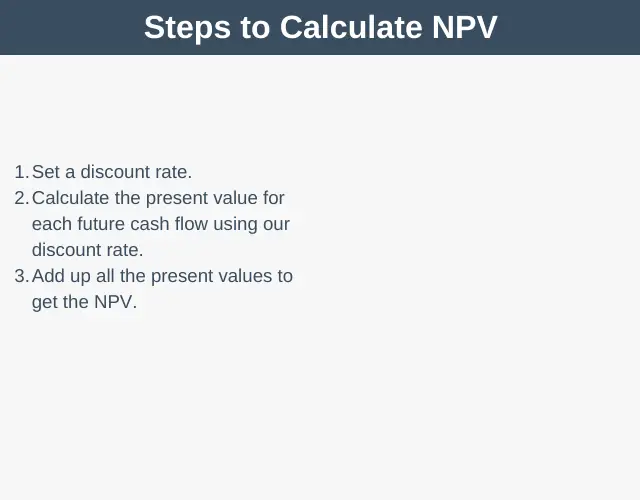

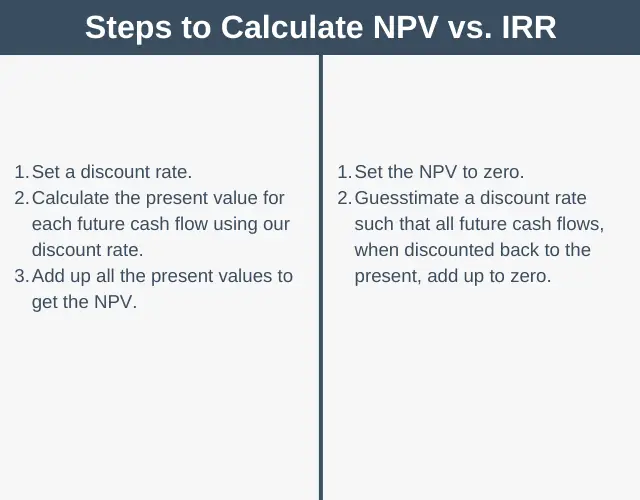

To calculate the NPV of this project, the steps you have to take are:

- Set a discount rate.

- Calculate the present value for each future cash flow using your discount rate.

- Add up all the present values to get the NPV.

Let’s apply these steps to our example.

Step 1: Set Discount Rate

For this project, we’ll set our discount rate to 10%, which is the hurdle rate our project must return per annum to be considered worthwhile.

If the project beats our hurdle rate, it will have a positive net present value, but if it doesn’t, the net present value will be zero or negative.

Step 2: Calculate Present Values

The second step is to calculate the present value for each future cash flow based on our 10% discount rate, and you can see the formula for doing this in the bottom right.

In the formula, we take a cash flow and divide it by one plus our discount rate, in this case, 10%, which we represent as a decimal (0.1). We then take that number (1.1) and raise it to the power of our time period.

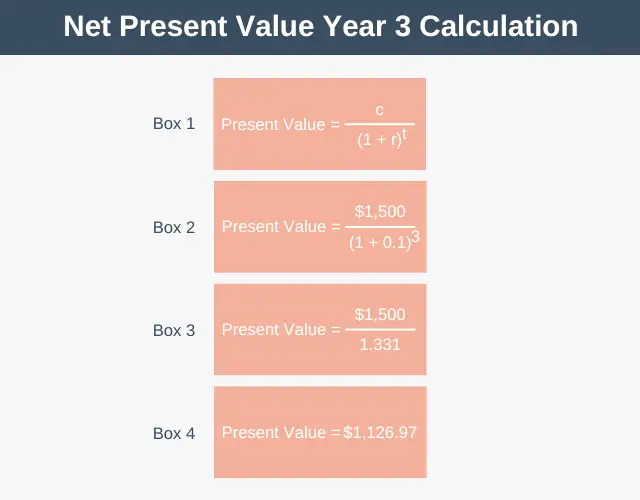

Let’s take a look at what that looks like for year three.

In box one, we have our present value formula for a single cash flow. In box two, we start substituting in our values, adding in our year three cash flow of $1,500, our discount rate of 10%, which we put in as 0.1, and our exponent, which is three because we’re calculating the present value of our year three cash flow.

In box three, we now work out the lower line for this equation, the denominator, getting 1.331. Finally, we divide $1,500 by 1.331 to get a present value for our year three cash flow of $1,126.97, shown in box 4.

Notice that money in the future isn’t worth as much to us as money in our hands today because of the time value of money. Again, check out our article on net present value if you need a recap of what that means.

Step 3: Add Up All The Present Values

Once we have a present value for every future cash flow, the final step is to add all those values together, giving us a net present value for the project of £375.66.

How to Calculate IRR

Now that we understand how to calculate net present value let’s calculate IRR. To calculate IIR, we flip the calculation around.

- Set the NPV to zero.

- Guesstimate a discount rate such that all future cash flows, when discounted back to the present, add up to zero.

Step 1: Set NPV to Zero

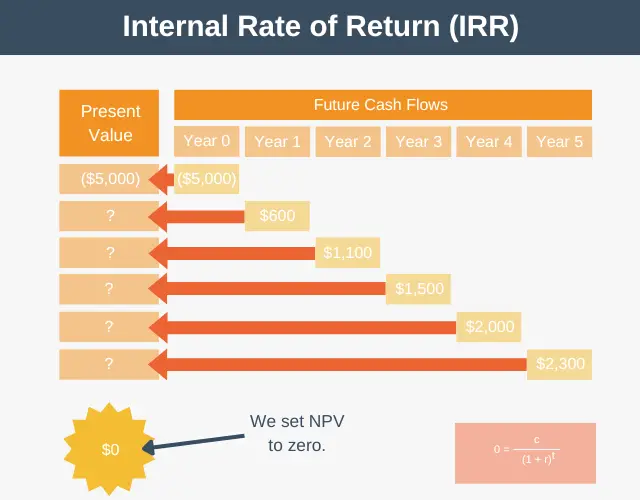

So if we want to calculate the IRR for our example, we would begin with something like this.

As you can see above, we’ve set the NPV to zero, so now we have to guess the discount rate.

Essentially, we have to guess what number to use as the discount rate to make all the present values add up to zero. IRR is a number that you can’t calculate, so it has to be found by trial and error.

Step 2: Guess the Discount Rate

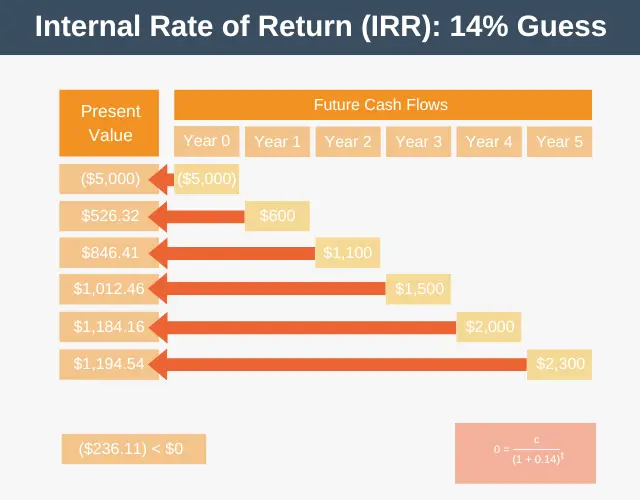

For our example, we already know that a discount rate of 10% produces a net present value of $375, so the IRR must be higher than this to get a zero NPV. So let’s guess at 14% and see what happens.

As you can see, 14% produces a negative net present value, so we’ve guessed too high for IRR. Let’s try again. At this point, we know the IRR is above 10% but below 14%, so this time, we’ll guess a discount rate of 12%.

This time we’re very close, but our net present value is still a bit negative, which means we have to increase our IRR guess a bit. If we keep guessing in this way, we’ll eventually find that a discount rate of 12.37% results in an NPV of zero. We can say the IRR for this project is 12.37%.

Internal Rate of Return in Excel

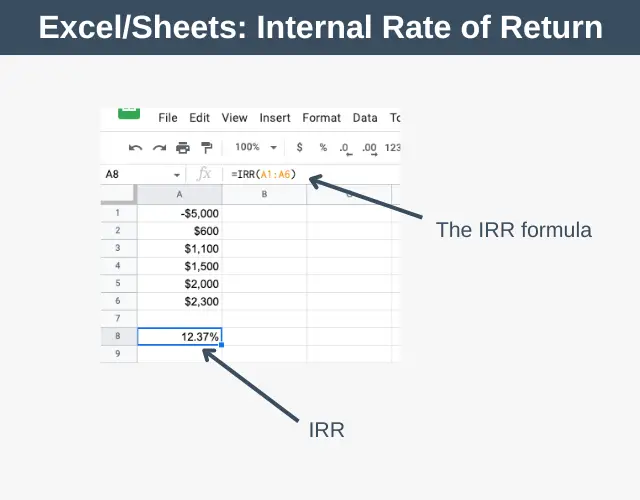

Now you know how to calculate the internal rate of return, but as you can see, it takes a lot of guesswork.

The good news is that there is a much speedier way to calculate the internal rate of return by using Excel or Google Sheets.

All you have to do is enter your cashflows and use Excel’s IRR function to estimate your internal rate of return.

Using IRR in Practice

So far, you’ve learned how to calculate IRR for a single project; however, the real power of IRR is that it allows you to compare different projects.

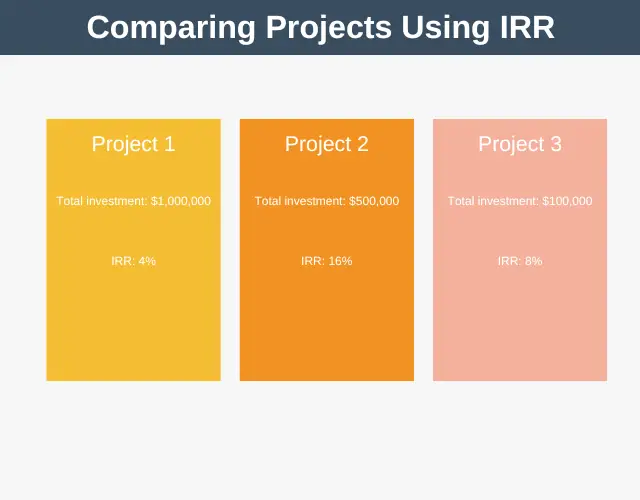

Suppose we have three projects under consideration for investment.

By calculating the IRR for each project, we can weigh them against each other, even though each project requires a different level of investment.

In the example, project two is the best investment in terms of IRR. One thing to note, though, is that you’re not just comparing projects to each other you have to also consider what else you could do with your investment. For example, if you could earn 20% interest from your bank, it would make more sense to put the money in your bank than to do any of these projects.

Advantages & Disadvantages

Advantages

- It allows you to compare projects of different sizes regardless of the investment size because IRR is a percentage.

- It accounts for the time value of money by converting future cash flows into present values.

- It’s simple to calculate in Excel and easy to understand – the bigger the IRR, the greater the project’s return.

Disadvantages

- IRR doesn’t tell you everything about if a project should go ahead. Other factors need to be considered, such as the risk profile of each project and the strategic benefit of completing each project.

- It only uses one discount rate, whereas, in reality, the actual discount rate can change over time, especially if you’re investing over a long period of time.

Summary

Internal Rate of Return is very similar to Net Present Value, but instead of deciding on a discount rate upfront, IRR works by calculating what discount rate will give us an NPV of zero.

Ultimately, the higher the IRR a project generates, the higher its return and the more attractive the project is (all other things being equal).