Whilst you may have a vague idea about the differences between long-term and short-term debt, in accounting terms there are some very clear differences between the two. There are also a number of factors to take into account when considering taking on one form of debt or the other.

In accounting terms, short-term debt is referred to as current liabilities. Current liabilities are debts that are due to be paid with one year. Similarly, long-term debts are called long-term liabilities in accounting parlance. These are debts that are due to be paid after one year.

The Balance Sheet

Both short and long term debt must appear on a company’s balance sheet.

Examples of short term debt include payroll taxes, short-term leases, bills due such as rent, water, and electricity. Examples of long term debt include deferred expenses and bonuses that are due in the next financial year.

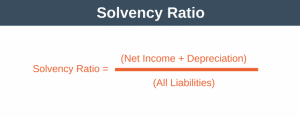

Obviously company debt is very different to personal debt just take a look at the personal debt management services here to see what I mean. An important metric which can be calculated from looking at the balance sheet is the debt-to-equity ratio. This is a safety ratio that gauges the burden of the debt within the company – essentially the risk associated with it. It is calculated by dividing the company’s total liabilities by its total equity.

How you interpret the debt to equity ratio differs from industry to industry, for example, it is common for high-tech companies to have a debt to equity ratio of under 0.5, whilst it is common for capital intensive industries to have a debt to equity ratio of above 1.5 or even 2. It is considered acceptable for capital intensive industries to have this higher debt to equity ratio as their debt will be backed by more tangible assets than a high tech companies debt.

Company debt can be a double edged sword – a little debt within the company can accelerate earnings and company growth, whilst too much debt can severely hinder the company by becoming too much of a burden and even leading to the company going bankrupt.

* Image by Brad_Chaffee