I’m going to be covering financial topics more and more over the coming months here on EPM, as it’s something I believe every manager needs to be aware of.

It never ceases to surprise me how many people I encounter in business who don’t understand anything about equities, annual accounts, and financial metrics. That strikes me as strange. Especially because the primary legal objective of ‘for profit’ organizations is to return money to shareholders, so if someone has chosen a career in business then why would they not know about the benchmarks by which business is measured?

Simply knowing some basic financial ratios and reading company accounts can tell you a lot about the company you work for, or a company you’re considering joining. Here are just a few of the many things you can asertain by having a working knowledge of corporate accounts and financial ratios:

1. A long history of high returns on equity (ROE) can tell you that the organization has a competitive advantage that is difficult for competitors to overcome. You can of course determine this from analysing the company’s product portfolio, but nothing backs up your analysis of the portfolio like seeing it in figures. Conversely, a fluctuating ROE provides a good indication that the fortunes of the organization a cyclical, changing through the business cycle.

2. It can be useful to identify how much of the profit is paid to shareholders and how much is reinvested in the business to boost future profits. From this you can infer a number of things such as how capital intensive the business is, and whether it is in a high growth or mature phase of business. You can then make a judgement as to whether the industry and company is right for you.

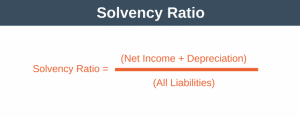

3. The indebtedness of the company and how easily this debt is covered by free cash flow is another important indicator. This obviously gives you an indication as to the longer term viability and sustainability of the organization.

4. You can understand the compensation of the company directors. Are they paid high salaries but with limited equity, or is it the other way around? Lower salaries with a high equity holding indicates that the people running the company have a vested interest in the company performing well and this should be taken as a positive sign.

5. The company’s accounts will also show you where in the portfolio revenue comes from, along with the geographical breakdown of this revenue. By looking at this data over a few years you will be able to see trends in the business, its portfolio, and its markets. This information can then be used to determine which area of the business you’d like to try and work in.

The five points above just scratch the surface of what you can find out about a company in 10 minutes using freely available information on the Internet.

The best book I have found covering not just the definition of financial ratios but what they actually mean, is The Intelligent Investor, by Ben Graham. This book was originally written in 1949, and the current reissue has commentary from Jason Zweig. The advantage of this is that you can see how those companies have fared since predictions were made about them all those years ago. The book is written from the point of view of someone interested in making stock market investments, and is a long read, but is definitely rewarding. Look out for more finance related updates here soon too.