Today’s post is by Eleanor Bell, manager of Michael Page’s Consultancy, Strategy & Change team who explains how professionals with proven customer journey improvement skills are in high demand and as banks and insurers look to engage customers to increase revenue and market share while also reducing cost.

Across the financial services sector the effects of the global economic crisis are still being felt. In the wake of this crisis retail and investment banks, and to a lesser extent insurance businesses, undertook cost reduction and integration activities aimed at reducing operational budgets to their lowest possible base. Many of these transformation programmes are ongoing.

But when cautious optimism returned to the financial services market as the economy started to expand again, the focus shifted to increasing revenue by improving customer engagement in tandem with the continued effort to reduce costs. Despite the uncertainty in the financial markets are experiencing in 2011, there is increased recognition that any major change programme needs to take into account customer interaction to drive satisfaction, and in turn, revenues.

Customer journey programmes explained

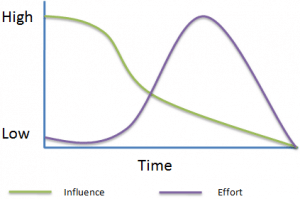

A customer journey programme has two main aims – to better engage with customers to provide a targeted service while using the opportunity to take cost out of the business. The end goal is increased revenues and market share and customer retention as customers spend and engage more as a result of the improved service levels.

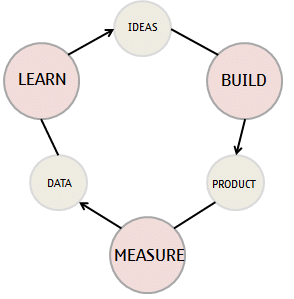

The decision is typically taken at board level to undertake this type of transformation activity. On a practical level, a customer journey programme team is created to examine all operational and support departments within an organisation to best ascertain how their service impacts on the customer journey. Widespread change and improvements will be implemented to optimise business processes around e-commerce, mobile banking or paperless statements, for example.

Recent high-profile customer journey programmes include:

Lloyds Banking Group – The integration of HBOS into Lloyds TSB that commenced in 2009 is projected to save the group £2bn in technology-related costs by the end of 2011. It includes the Galaxy programme, the delivery of a single internet banking platform that is due for completion in autumn 2011. The goal is to move the organisation to a single platform to simplify and streamline the journey that customer undertakes to bank online, while automating process and removing legacy systems to reduce cost.

Many major banks and financial services organisations including Royal Bank ofScotland, AXA, Nationwide and Deutsche Bank have built and continue to expand lean transformation teams to apply process improvement expertise to the customer journey.

The success of a customer journey programme can be measured by:

- Reaching targets for improved sales metrics and customer retention

- Realising intended cost reduction and savings

- Whether the programme is completed on time and in budget

- Feedback from customers

Opportunities for candidates

The approach frequently utilised in customer journey improvement is to create a joint programme team comprising of management consultancy specialists and in-house experts to define the strategy and programme deliverables. The implementation and delivery phases are increasingly handled by specialist interims to mitigate the cost factors of engaging a consulting firm for the duration of the programme.

So the areas of opportunity for strategy jobs for professionals with customer journey improvement experience and financial services exposure exist within management consultancies and as well as in-house roles for both permanent and interim employees.

On the whole, employers prefer candidates who have similar sector experience. Within the financial services industry, specific sector experience is typically required as the customer journey in an investment bank to different to that of someone trying to make an insurance claim, for example. Candidates with insurance claims process experience are in very high demand at present. With a demonstrable functional track record, consulting experience may also be considered as it shows the ability to pick up the intricacies of a industry quickly.

Candidates looking to develop their abilities and experience to transition into the ever-growing customer journey improvement arena should focus on developing transferable skills. Those with a sale and marketing background can move across but it is key to get involved in change programmes at a departmental level to gain exposure to the process. Formal project management qualifications and process training, like Six Sigma, are also important and those with a proven track record in these areas can readily apply them to customer journey improvement programmes.

If you’re looking for your next change, strategy or consulting job in customer journey improvement, please get in touch with Eleanor Bell.

T: 020 7269 6247

E: eleanorbell@michaelpage.com